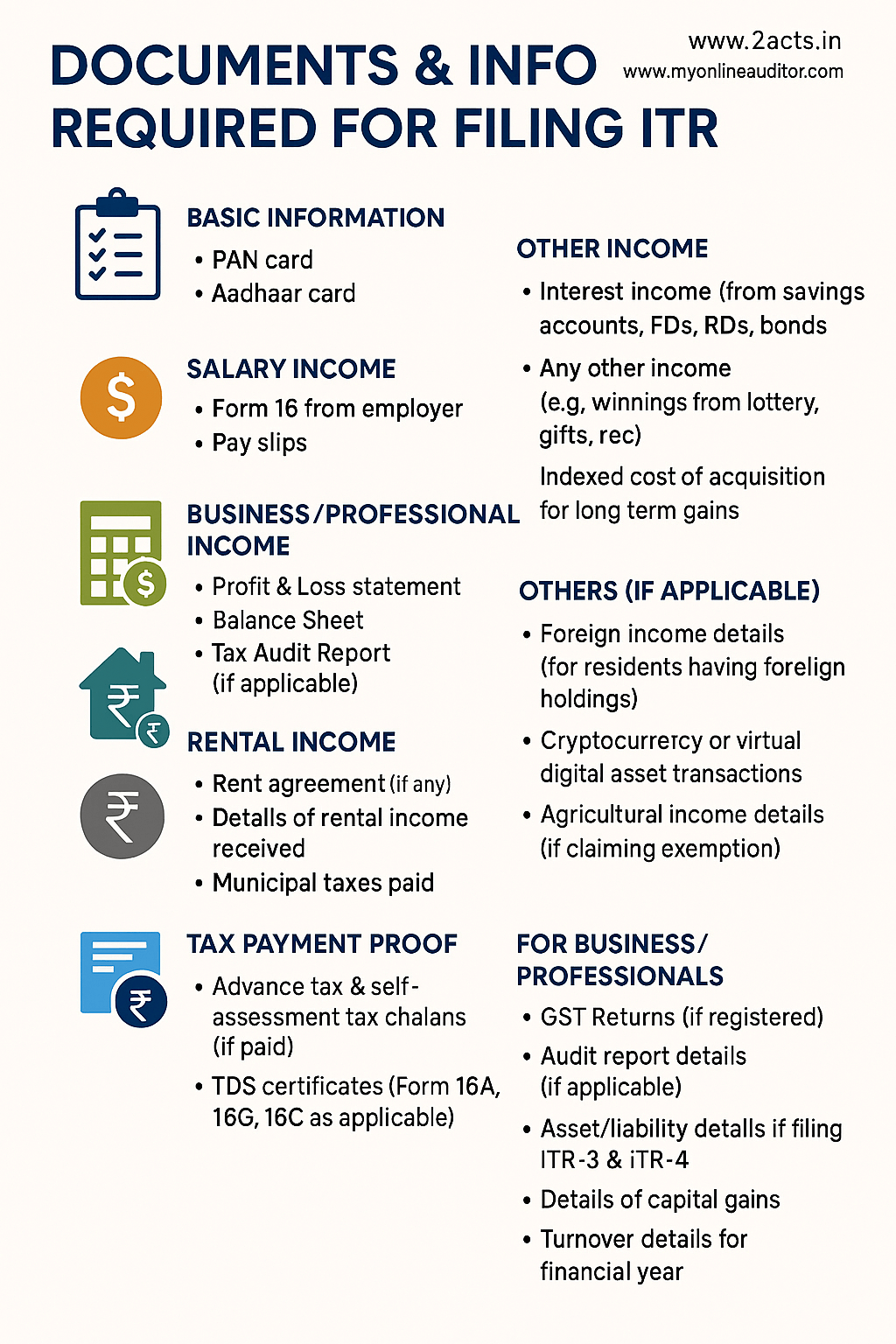

Basic Information

- PAN card

- Aadhaar card

Salary Income

- Form 16 from employer

- Pay slips

Business/Professional Income

- Profit & Loss statement

- Balance Sheet

- Tax Audit Report (if applicable)

Rental Income

- Rent agreement (if any)

- Details of rental income received

- Municipal taxes paid

Tax Payment Proof

- Advance tax & self-assessment tax chalans (if paid)

- TDS certificates (Form 16A, 16G, 16C as applicable)

Other Income

- Interest income (from savings accounts, FDs, RDs, bonds)

- Any other income (e.g., winnings from lottery, gifts, rec)

- Indexed cost of acquisition for long term gains

Others (if applicable)

- Foreign income details (for residents having foreign holdings)

- Cryptocurrency or virtual digital asset transactions

- Agricultural income details (if claiming exemption)

For Business / Professionals

- GST Returns (if registered)

- Audit report details (if applicable)

- Asset/liability details if filing ITR-3 & ITR-4

- Details of capital gains

- Turnover details for the financial year